One of the Leading Renewable Energy companies, Suzlon Energy Ltd, has been a popular choice among investors. It’s headquartered in Pune. The Suzlon Energy Ltd Today Share Price is running at ₹49.43

as of 12th February 2025. This article will explore the in-depth analysis of Suzlon Share Price Target for the upcoming years ahead in 2025, 2026, 2027, 2028, 2029, 2030, and 2050. Here, we will analyse the fundamental, forecast and technical aspects along with the outlook for future growth.

Suzlon Energy Ltd: An Overview

Suzlon Energy Ltd. is an Indian multinational wind turbine manufacturer. It is one of the leading brands in the Renewable energy industry. The company was established in 1995 by Tulsi Tanti and has since grown into one of the largest wind energy companies globally. Suzlon Energy specializes in manufacturing wind turbine generators (WTGs), as well as project development, installation, and maintenance. This company operates in 17 countries, including Thailand, Australia, the USA and South Africa, with 14 manufacturing plants in India.

Recent reports show Suzlon has installed over 20 GW of wind energy capacity and is a pioneer in low-wind-speed turbine technology. Suzlon’s market capitalization hits the mark of 1 lakh crore (approximately US$11.6 billion). To know more about the Suzlon Vision & Mission, you can visit the official website.

Suzlon Share Price Performance Overview

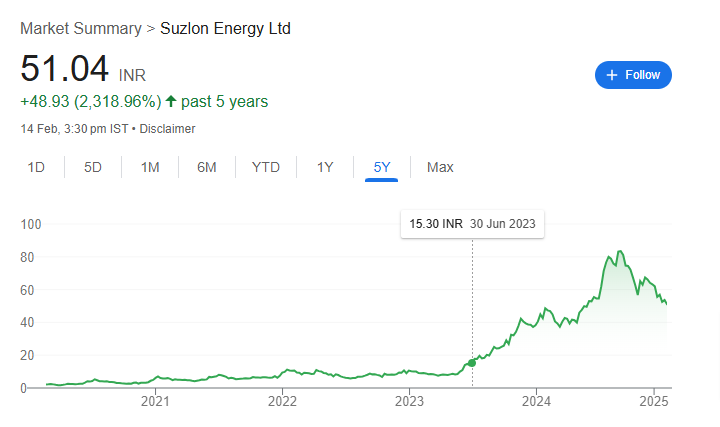

Suzlon has faced many ups and downs in its stock market journey since its IPO launch till now. To measure the upcoming share price target of Suzlan Energy, we need to analyse its current and historical share price performance, which are as follows:

Suzlon Share Price Historical Performance

Suzlon Energy Ltd was listed on the stock exchanges by launching its Initial Public Offering(IPO) at the price of Rs 5. The Share Price of Suzlon has faced a rollercoaster journey in the past five years. In Feb 2020, the company share price was between RS 2.11 and 3. In 2021, the share price fluctuated between Rs 4.91 and9.37AtIn the end of 2022, the share price of Suzlon increased to Rs 10.60.

There is a possibility of a huge change in the share price of Suzlon between 2023 and 2024. In September 2024, the share price rose to Rs 81.09, which is the highest price ever in the journey of Suzlon Energy’s share price. In the initial period, the titans provide the Multibagger Returns to the investors.

Suzlon Shares has given an impressive return of 2219.57% to investors since its IPO. It means that if someone invested ₹10,000 five years ago, then their investment would be worth ₹2,31,957.

Suzlon Share Price Current Performance

The Suzlon Share Price is currently running at Rs 49.85 and has been continuously declining for the last 6 months. The share price has been experiencing a decline since September 2024. Suzlon Share fluctuated between Rs 44.90 to Rs 53.41 till now. Suzlon share price has declined by around -1.84% in the last month. But, in his overall 5-year analysis, it provides a return of 2219.57%, which is huge for investors. According to an expert, then, the concerns about sustainable development and green energy can affect the price of Suxlon Energy Ltd is high.

Suzlon Share Fundamental Analysis

| Metric | Value |

| Market Cap | 72,222.42 Cr |

| 52-Week High | ₹86.04 |

| 52-Week Low | ₹35.50 |

| Face Value | ₹2 |

| Book Value | ₹2.72 |

| Return on Equity (ROE) | 26.31% |

| Return on Capital Employed (ROCE) | 24.9% |

| P/B Ratio | 18.71 |

| P/E Ratio | 63.67 |

| Dividend Yield | 0% |

| Sales Growth (YoY) | 9.5% |

| Profit Growth (YoY) | 91.13% |

| Earnings Per Share (EPS, TTM) | 0.29 |

| Promoter Holding | 13.25% |

| Net Profit Margin | 13.03% (Dec 2024) |

| Debt-to-Equity Ratio | 0.18 |

Suzlon Share Technical Analysis

The Technical Analysis of Suzlon Energy Ltd is given below. We just shared the basic insight below:

- Trend Analysis: According to the Long-Term Trend Analysis (6+ months), the Suzlon Share Price is neutral to slightly bullish. This is driven by the company’s improving fundamentals and growth prospects in the renewable energy sector.

- Moving Averages: Suzlon Energy is trading below the 50-Days SMA at ₹45.50 but remains trading above the 200-day SMA at ₹38.20. A break above ₹45.50 could signal a recovery, while a drop below ₹38.20 could signal long-term weakness.

- Support & Resistance Levels: As of 12 Feb 2023, Suzlon’s share price closed the day at ₹52.36 – 0.71% higher than the previous closing price. The main resistances to watch for the next trading session are 54.09, 55.51, and 58.03. On the other hand, the main support levels can be found at 50.15, 47.63, and 46.21. Please note that these support and resistance levels are derived from classic pivot tables.

- RSI & MACD Indicators: The RSI (14) of the Suzlon Share is currently 37.44, which means it is under the neutral zone. It indicates neither overbought nor oversold conditions. It indicates a lack of strong momentum in either direction. Suzlon’s MACD (12, 26) is -0.02, which is negative. It is indicating bearish momentum. This suggests that the short-term moving average is below the long-term moving average, which is typically a signal of potential downward pressure on the stock.

Suzlon Share Price Target 2025, 2030, 2035, 2040, 2045 and 2050

The Suzlon Share Price Target for the upcoming years is given below:

| Year | Share Price Target Range (₹) |

|---|---|

| 2025 | ₹89-₹142 |

| 2026 | ₹135-₹180 |

| 2027 | ₹162-₹277 |

| 2028 | ₹230-₹341 |

| 2029 | ₹294-₹403 |

| 2030 | ₹425-₹585 |

| 2035 | ₹1040-₹695 |

| 2040 | ₹1040-₹695 |

| 2045 | ₹2160-₹1620 |

| 2050 | ₹2160-₹1620 |

Read Alos: IRFC Share Price Target 2025, 2030 to 2050

Suzlon Share Price Target 2025

As per the current performance, Suzlon has increased its gross sales in 2024. It increased from ₹1,560 crore in 2023 to ₹2,196 crore in 2024. The company’s operating profit also rose from ₹248 crore (2023) to ₹357 crore (2024). As per the previous growth rate and upcoming project indicated, the Suzlon Price will increase and provide a multi-bagger return to their investors. The Suzlon Share Price in 2025 will be like:

| Higher Target | ₹142 |

| Lower Target | ₹89 |

During the first half of the 2025 Year, the Company’s share price may go up to ₹125.. In the second half of the year, the share price will range between a minimum of ₹89 to a maximum of ₹142. As per the market behaviours, the Suzlon Price will also move upwards. The. The strong order book and strong financial performance will also increase the Share price of Suzlon in the 2025 budget, the 2025 allocation for the energy sector directly affects the Suzlon price.

Suzlon Share Price Target 2026

As we know, Suzlon Energy is a key player in renewable energy, manufacturing wind turbines and generators. The company installed India’s largest windmill (160 meters) in 2023, operational even in low winds. With the increasing demand for renewable energy, the Suzlon Share Price Target could range between ₹135 to ₹180 by 2026.

| Higher Target | ₹188 |

| Lower Target | ₹135 |

Suzlon Share Price Target 2027

Suzlon has a strong financial presence in the market and is one of the leading brands in the renewable energy sector. Suzlon’s net profit for the year 2024 was increased to ₹256 crore, which is higher than ₹203 crore as of 2023. The company also improved its Earnings Per Share (EPS) from 0.15 (2023) to 0.19 (2024). After measuring this performance, if the company continues profitability, it will push the share price to ₹162 to ₹277 by 2027.

| Higher Target | ₹277 |

| Lower Target | ₹162 |

Suzlon Share Price Target 2028

Suzlon mainly focuses on growing their sales up to 5% to 7% this year. The Suzlon’s sales growth improved from 5% (5-year average) to 25% (3-year average). If the company sustains its sales growth, it could drive the share price to ₹230 –₹341 by 2028.

| Higher Target | ₹341 |

| Lower Target | ₹230 |

Suzlon Share Price Target 2029

In the last 10 Years analysis, the company’s Profit growth increased from 8% (10-year average) to 219% as of 2023. In the last 3 years, this growth has reached 45%. If profit growth maintains as well, the share price could reach between ₹294 to ₹403 by 2029.

| Higher Target | ₹403 |

| Lower Target | ₹294 |

Suzlon Share Price Target 2030

The company has given a CAGR of 21% in the last ten years, which has increased to 109% in the last five years. And in the last three years, it has reached 139%. Last year, the company’s CAGR was 214%.

Suzlon Limited company has well-managed total liabilities and assets. If the company manages its financial position in future as well, then Suzlon’s share price target in 2030 can be ₹425 to ₹585. The higher and lower target values could be:

| Higher Target | ₹585 |

| Lower Target | ₹425 |

Suzlon Share Price Target 2035

The Suzlon total liabilities were Rs 5523 crore in 2023, which increased to Rs 7179 crore in 2024. The total assets of the company also rose to Rs 7,165 crore, which is an 18.5% increase from the previous year. Suzlon Energy Ltd. is expected to dominate the wind power sector in India, with a focus on large-scale wind farms till 2035. If the company maintain sustainability and their vision, then the share price will be:

| Higher Target | ₹1040 |

| Lower Target | ₹695 |

Suzlon Share Price Target 2040

In the peer comparison, the company’s competitors are paying small amounts of dividends to their investors. If the company starts to give high dividends to their investors, it will become a major attraction for investors in the Renewable Energy Sector. It is predicted that Suzlon could become a global renewable energy giant with a strong presence in multiple countries and a diversified revenue stream by 2040. If this thing happens, the sharp receive will be:

| Higher Target | ₹1585 |

| Lower Target | ₹1125 |

Suzlon Share Price Target 2045

Suzlon’s major focus on innovation, such as next-generation wind turbines and AI-driven energy management systems. Along with that, the company also managed strong financial performance with consistent revenue and profit growth for the long term.

It may operate some of the world’s largest wind parks, including projects in the Western Ghats and offshore locations till the end of 2045. So, by 2045, it could be a pioneer in advanced renewable energy technologies, which contribute significantly to global decarbonization efforts. If the company achieves its vision by 2045, the share price would be:

| Higher Target | ₹2160 |

| Lower Target | ₹1620 |

Suzlon Share Price Target 2050

India’s potential to emerge as a global economic superpower drives demand for renewable energy. Suzlon could play a key role in India’s renewable energy infrastructure, supporting the country’s target of 500 gigawatts of renewable energy capacity by 2030 and beyond. It has the potential to become one of the leading companies in the world in Renewable energy. It will increase the Share Price of many as well. By 2050, if the company achieves its goal, the share price will be:

| Higher Target | ₹3250 |

| Lower Target | ₹2250 |

Suzlon Share Price Target 2025 to 2030: Growth Factor

Some factors directly affect the Share Price Tags of Suzlon from 2025 to 2030. These factors are for the following:

- Renewable Energy Demand: After the climate change concerns, the world moved to Renewable Energy, which is essential for sustainable development in upcoming years. India’s target of achieving 500 GW of renewable energy capacity by 2030. It will directly benefit Suzlon, as it is a leading player in the wind energy sector.

- Government Policies and Incentives: Government flexible policies for the Renewable Energy industry and subsidies, tax incentives, and renewable energy targets are expected to boost Suzlon’s growth in the long term view.

- Technological Advancements: After the huge revolution in technology, Suzlon is focusing on the generation of new wind turbines and hybrid energy solutions (wind + solar), which improve efficiency and reduce costs.

- Debt Reduction and Financial Health: Suzlon has significantly reduced its debt burden in recent years and improved the company’s financial stability.

- Global Expansion: Suzlon has the vision of dominating teh global market in the field of renewable energy till 2040. It operates in 17 countries and has installed over 19 GW of wind energy capacity worldwide.

- Increasing Investor Confidence: After launching its IPO, Suzlon provided the Multibagger return to its investors, which increased the confidence of the investors for the company.

Suzlon Energy Ltd Peer Comparison

| Scrip Name | Price | Daily Change | M.Cap (Cr) | 1 Year Returns % | P/E (TTM) | PB Ratio |

|---|---|---|---|---|---|---|

|

Suzlon Energy Ltd

| 51.14 | -2.21 | 72,222.42 | 21.53 | 184.00 | 18.71 |

|

Triveni Turbine Ltd

| 588.70 | +22.40 | 18,001.37 | 27.10 | 57.94 | 20.50 |

|

TD Power Systems Ltd

| 332.35 | -12.60 | 5,387.55 | 21.06 | 37.22 | 7.05 |

|

Schneider Electric Infrastructure Ltd

| 627.45 | -37.05 | 15,888.20 | 20.32 | 78.08 | 39.71 |

|

Surana Solar Ltd

| 34.37 | -1.65 | 177.24 | 6.10 | 277.23 | 3.12 |

|

Veto Switchgears & Cables Ltd

| 102.67 | -13.77 | 222.57 | -8.75 | 7.08 | 0.89 |

Holding Pattern of Suzlon

| Promoter Shareholding | 13.25% |

| FII Shareholding | 22.88% |

| DII Shareholding | 9.31% |

| Public Shareholding | 54.56% |

Suzlon’s Share Investment Opportunities and Risk

Opportunities: Suzlon is the best opportunity for investors who want to invest for the long term. Due to the demand for renewable energy, Suzlon could be one of the emerging key players in the global Market. The company operates in 17 countries, and government policy for green and renewable energy can also support Suzlon to become a highly profitable investment sector. Suzlon’s tie-ups with many big companies and projects in domestic and international markets would also make it strong.

Risk: Suzlon’s high debt levels and financial instability burden can directly impact growth. Sensitivity to regulatory changes and global market fluctuations could be a hindrance to its growth.

Conclusion

Suzlon is a key player in the Renewable Energy Sector, which is one of the best investing sectors for upcoming years. The Government policy for sustainable developments indicated the strong support of the government for renewable energy sector companies. However, vectors should analyse and ensure all the economic factors and trends before making any investment in the company. They should research and analyse at the micro level.

FAQs

What is the price of Suzlon in 2025?

The expected share price for Suzlon may go up to ₹125 during the first half of 2025. In the second half of the year, the share price will range between a minimum of ₹89 to a maximum of ₹142. As per the market behaviors, the Suzlon Price will also move upwards

What is the target price of Suzlon?

The Analysts have set a median 1-year price target of ₹73 for Suzlon Energy, suggesting a potential upside of approximately 44% from the current market price of ₹51

Is Suzlon share a good buy?

As per the various research, Suzlon’s Share Price will be going up in some upcoming months. JM Financial and ICICI Securities have a Buy rating on Suzlon with a target price of Rs 80. They are bullish on its strong execution over the next 18 months.

Disclaimer:

Stock market investments are subject to risks. The predictions provided are based on research and past trends, and investors should do their analysis before making financial decisions. Make sure to ask and consult with industry experts and investors