Hey Investors! Are you looking for a strong fundamental penny stock company? Then, you should consider and analyse DEN Network Limited company. It is an Indian cable television and broadband service provider company in India. It’s headquartered in New Delhi India. S.N.Sharma is CEO of the DEN Networks. The DEN Networks Ltd Today Share Price ₹33.74. In this post, you will explore the complete analysis of DEN Networks Share Price Target for the upcoming years ahead in 2025, 2026, 2027, 2028, 2029, 2030, and 2050. Stay tuned with us.

DEN Networks Company: An Overview

One of the Key Leading Players in the Telecommunications Industry, DEN Networks Ltd was established in 2007 by Sameer Manchanda. It is owned by Sameer Manchanda and was acquired by Reliance Industries in 2018 along with Hathway. On 17 October 2018, Reliance Industries announced that it had acquired a 66% stake in DEN for ₹2,290 crore (US$260 million). Currently, Reliance Industries has a 78.62% stake in DEN Networks. The company’s revenue as per the Q3 results 2024 was ₹315.79Cr.

It is providing unmatched visual entertainment to its customers through cable TV, over-the-top (OTT) entertainment and broadband services. They curate media content of various genres from various broadcasters and entertain over 13 million homes across 13 major states and 433 cities in India and have the largest subscriber base among all cable players in India. The first IPO launch date for Den Networks was 28 October 2009 and the shares were listed on 24 November 2009.

DEN Network Share Price Performance Overview

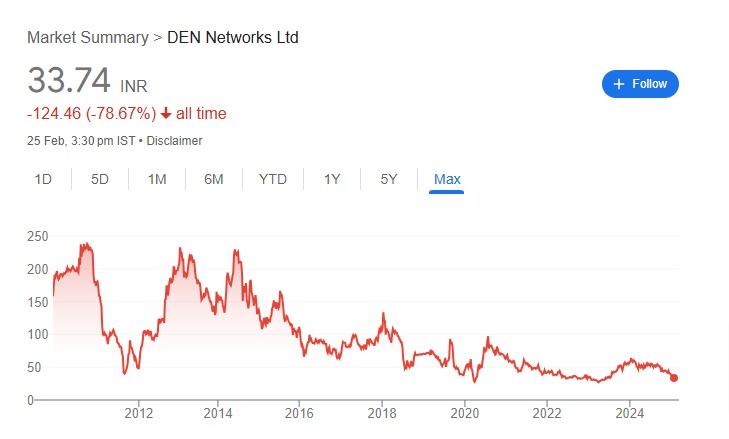

The DEN Network Share Piurc was Rs158 in the initial stage, but now it is stuck between the INR 30-40 Price Range. To deeply analyze the trend and up & down in the Share Price of DEN Network, we should look out the Historical and Current Performance of the market and share price. The performance of the DEN Network Share Price is as follows:

Historical Performance of DEN Network Share

The initial share price of Den Networks Limited (DEN) during its IPO in 2009 was ₹195–₹205 per share. The company’s share price has been experiencing price erosion due to many reasons like, poor financial performance, market changes, etc. If we analyse the overall Share Price Overview of DEN Network, then you can see the ups and downs in the Share Price.

In 2009 the Share Price remained between INR 180 to 187. But, the year 2010 was quite impressive for the DEN Network. It started to form INR 190 and in the mid of 2010, it went up to INR 237.89 till September 2010. After that, the Share continuously decreases.

The year 2011 was a bit challenging for the company’s stock as the share price fell from Rs 158.95 to Rs 49.70 during this period. In early 2012, the network’s stock gained momentum and the shares rose from Rs 59.75 to Rs 232.60 by February 2013. Between 2014 to 16 the Share Price margin was Rs 160.50 to Rs 82.65.

According to available data, DEN Networks’ Share price in 2017 was generally in the mid to high 50s, while it saw a significant decline in 2018, trading mostly in the low 30s to low 40s. In 2019 it fluctuated within a similar price range, with a trend towards lower values throughout the years; reflecting a substantial decline in share price from 2017 to 2018 and continued volatility in 2019.

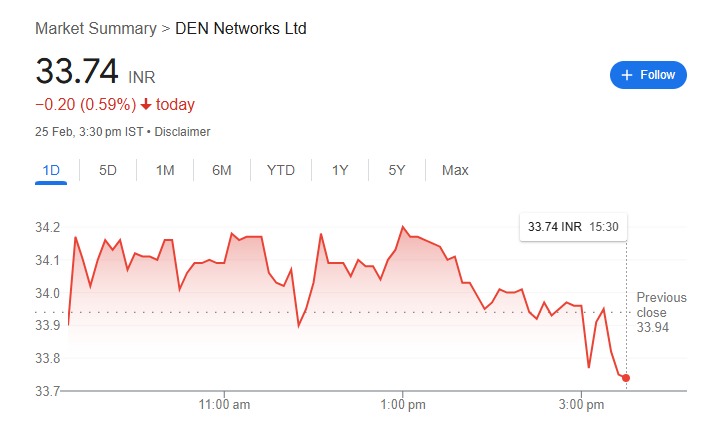

DEN Network Current Share Price Performance

As of 20 February 2025, the current share price of DEN Network is 35 INR. The share price has been declining since October 2024. From January 2025, the Share Price fluctuated between Rs 43.80 and Rs 35. The Den’s Share declined 34.62% in the previous six months. The share price of DEN Network has been declining for the last five years.

DEN Network Ltd Share Fundamental Analysis

| Metric | Value |

| Market Cap (In Cr.) | ₹1,645.47 |

| 52-Week High | 60.65 |

| 52-Week Low | 32.84 |

| Face Value | ₹10 |

| Book Value | ₹75.78 |

| Return on Equity (ROE) | 6.61% (Feb 2025) |

| Return on Capital Employed (ROCE) | 5.71% (March 2024) |

| P/B Ratio | 0.44 |

| P/E Ratio | 7.60 |

| Dividend Yield | 0.00% |

| Sales Growth (YoY) | 4.48% YoY (Q3 FY 2024-25) |

| Profit Growth (YoY) | 12% YoY (Q3 FY 2024-25) |

| Earnings Per Share (EPS, TTM) | Rs 3.68 |

| Promoter Holding | 74.9% |

| Net Profit Margin | 15.46% (Dec 2024) |

| Debt-to-Equity Ratio | 0.7% |

DEN Network Ltd Technical Analysis

The Technical Analysis of DEN Network Ltd is given below. We just shared the basic insight below:

- Trend Analysis: According to the Long-Term Trend Analysis (6+ months), the DEN Network Share Price is neutral to slightly bearish. This is driven by the company’s declining financial performance and poor profit growth.

- Moving Averages: As of February 21, 2025, DEN Networks Ltd. (NSE: DEN) is trading at ₹34.17. The stock’s 50-day simple moving average (SMA) is ₹39.6, and the 200-day SMA is ₹48, which indicates that the current price is below both averages. This indicates a bearish trend.

- RSI & MACD Indicators: The RSI (14) of the DEN Network is RSI(14) Rs 44.248. It indicates that neither overbought nor oversold conditions. The MACD (12,26) is 0.05. Which indicated the strong Buy position of Shares.

Den Networks Share Price Target 2025 to 2050

All investors can predict and get the expected share price target by analysing and evaluating the company’s financial performance and upcoming trends and market changes. We will provide you with the share price predictions of DEN Network for 2025 and upcoming years 2026, 2027, 2028, 2029, 2030, 2035, 2040, 2045 to 2050. By measuring these aspects, you will make a rough, graph of the DEN Network Share Price. Look out the year-by-year Share Piece Target:

| Year | Share Price Target Range (₹) |

|---|---|

| 2025 | ₹32-₹65 |

| 2026 | ₹60-₹92 |

| 2027 | ₹95-₹142 |

| 2028 | ₹145-₹193 |

| 2029 | ₹195-₹260 |

| 2030 | ₹265-₹405 |

| 2035 | ₹590-₹775 |

| 2040 | ₹910-₹1180 |

| 2045 | ₹1200-₹1400 |

| 2050 | ₹1480-₹1675 |

Read Also: IRFC Share Price Target 2025, 2030 to 2050

Den Networks Share Price Target 2025

DEN Network Company has recorded a revenue of Rs 13,513 million in FY 2024-23, which is a decrease of 2.4% from the previous year. The company’s net income is 79 Crore Rs. As of FY 2023-24, the company’s Net profit was Rs 2,364 million. As per the financial analysis, the company will record a huge Net Profit of up to 10 % to 25 % by 2030. There is also a huge increment in the EPS, which is recorded as 5.09 in 2023. It’s increased up to 1.4 in comparison to last year. The January 2025 Share price of DEN was Rs 43.89. If the company maintain improv Revenue growth and profit, the share price target for 2025 will be:

| DEN Network Share Price 2025 Months | Lower Target | Higher Target |

| February | 32 | 39 |

| March | 34 | 38 |

| April | 37 | 41 |

| May | 40 | 43 |

| June | 41 | 45 |

| July | 43 | 47 |

| August | 47 | 51 |

| September | 50 | 55 |

| October | 52 | 58 |

| November | 55 | 61 |

| December | 59 | 65 |

Den Networks Share Price Target 2026

DEN Network Ltd was one of the company, which hit the Price of Rs 200+ in just a few years, but due to the wrong financial management and lack of economic foresight, the company’s stock fell to Rs 32- 35 in February 2025. After the 67% stake owned by Reliance Industry, there is hope that the Share Price will rise in upcoming years if ca company changes its Policies and works on new projects for company growth. If we analyse the Past 5 Years’ Share Price, then the company gave a Share Return of –44.61 % to the visitors. But, the Growth of the Share Price in 2024 and 2o25 is quite impressive in comparison of 2022 and 2023. If the growth is maintained then the Den Network’s Share Price for 2026 will be like this:

| DEN Network Share Price 2026 Months | Lower Target | Higher Target |

| January | 60 | 64 |

| February | 62 | 66 |

| March | 63 | 68 |

| April | 66 | 71 |

| May | 69 | 73 |

| June | 70 | 74 |

| July | 73 | 79 |

| August | 76 | 80 |

| September | 77 | 82 |

| October | 80 | 83 |

| November | 83 | 87 |

| December | 86 | 92 |

Den Networks Share Price Target 2027

In the last three years, the company equity returns were only 5%. As of FY 2023, the company’s Operating income fell 8.5% on a year-on-year (YoY) basis. In March 2024, the company recorded a Net Sales of 10,348. In March 2023, it was 11,305. The net profit margin of DEN Network in 2023 was 20.9%, which decreased in March 2024 to 17%. But, In 2025, there will be huge chances to record the Hiaprofit margin. If the company does it well. The Tagated Share Price Of the Company for 2017 will be:

| DEN Network Share Price 2027 Months | Lower Target | Higher Target |

| January | 95 | 102 |

| February | 99 | 107 |

| March | 103 | 108 |

| April | 106 | 110 |

| May | 109 | 116 |

| June | 113 | 119 |

| July | 118 | 124 |

| August | 122 | 129 |

| September | 126 | 131 |

| October | 130 | 135 |

| November | 133 | 137 |

| December | 135 | 142 |

Den Networks Share Price Target 2028

As of March 2024, Den Networks’ non-current liabilities were ₹44.29 billion. DEN Networks Limited had total assets of ₹40,132 million, which included ₹30,634 million in current assets and ₹9,499 million in fixed assets as of March 2024. It means the company has well managed the Total Assets and liabilities. If the company give the return for the years 2023 and 2024, then the expected Share Price Target of DEN Network for 2028 should be:

| DEN Network Share Price 2028 Months | Lower Target ( | Higher Target |

| January | 145 | 152 |

| February | 149 | 154 |

| March | 151 | 157 |

| April | 154 | 160 |

| May | 158 | 163 |

| June | 161 | 166 |

| July | 165 | 169 |

| August | 168 | 173 |

| September | 171 | 178 |

| October | 175 | 181 |

| November | 179 | 186 |

| December | 184 | 193 |

Den Networks Share Price Target 2029

The DEN Network is constantly reporting the degradation in revenue and Profit. But, still,l the company manage their financial stability as well. Den Network Ltd is planning to make major changes in policies and future outlook. If the company have assigned any project for long-term growth, then the predicted Share Price of DEN Network Ltd in 2029 will be like:

| DEN Network Share Price 2029 Months | Lower Target | Higher Target |

| January | 195 | 200 |

| February | 200 | 203 |

| March | 202 | 209 |

| April | 206 | 212 |

| May | 210 | 216 |

| June | 214 | 219 |

| July | 217 | 222 |

| August | 220 | 228 |

| September | 225 | 234 |

| October | 230 | 240 |

| November | 240 | 248 |

| December | 250 | 260 |

Den Networks Share Price Target 2030

The DEN Network’s gross profit in March 2023 was Rs 103 Million, but in 2024, the company has reported to loss. But, If the company focus on its financial management and changes its policy, then it should be beneficial for DEN Network Share. The company’s EBIT was ₹66.72 crore and a profit after tax (PAT) was ₹79.06 crore in March 2024. In 2024, DEN Network Ltd has a total income of ₹312.63 crore and total expenses of ₹245.91 crore.

| DEN Network Share Price 2030 Months | Lower Target | Higher Target |

| January | 265 | 272 |

| February | 270 | 280 |

| March | 275 | 288 |

| April | 282 | 295 |

| May | 290 | 300 |

| June | 305 | 320 |

| July | 315 | 330 |

| August | 320 | 340 |

| September | 335 | 355 |

| October | 350 | 365 |

| November | 365 | 390 |

| December | 385 | 405 |

Den Networks Share Price Target 2035

Reliance acquired an additional 12.05% stake in DEN in March 2019 taking its total stake in the company to 78.62%. So, Reliance can significantly impact DEN Network’s growth by leveraging its large customer base, robust infrastructure, and strong brand recognition to expand DEN’s reach, particularly in the broadband segment. Then, the DEN Network Makret performance will also improve. The expected Share Price Target of DEN Network in 2035 will be like:

| DEN Network Share Price 2035 Months | Lower Target | Higher Target |

| January | 590 | 605 |

| February | 610 | 630 |

| March | 620 | 645 |

| April | 650 | 675 |

| May | 665 | 680 |

| June | 680 | 695 |

| July | 690 | 710 |

| August | 700 | 725 |

| September | 722 | 734 |

| October | 730 | 745 |

| November | 750 | 765 |

| December | 760 | 775 |

Den Networks Share Price Target 2040

The DEN Network’s growth strategy includes acquiring majority stakes in other cable companies to expand into new states. The company is also rolling out broadband internet in select areas. The DEN Network is on the path to becoming the most trusted and leading company in Indian cable television and broadband service. If the company look for a great project in OTT and Broadband, then the Share Price of DEN NeNetworkill will increase. The expected DEN Network share piece target for 20240 will be:

| DEN Network Share Price 2040 Months | Lower Target | Higher Target |

| January | 910 | 930 |

| February | 920 | 940 |

| March | 935 | 955 |

| April | 950 | 970 |

| May | 965 | 985 |

| June | 990 | 1020 |

| July | 1020 | 1050 |

| August | 1060 | 1090 |

| September | 1095 | 1110 |

| October | 1100 | 1130 |

| November | 1120 | 1160 |

| December | 1150 | 1180 |

Den Networks Share Price Target 2050

India’s GDP growth is increasing day by day, which indicates that the company established in Idnian is also reporting growth as well. The India mission of Digital Revolutions is directly beneficial for the DEN Network. India is also one of the most populated countries, so the consumers of Network Broadband and OTT Services are also here. It means the DEN Network has the strong potential to become a highly growing company till 2045. The Targeted Share Price of DEN Network for 2025 will be:

| DEN Network Share Price 2050 Months | Lower Target | Higher Target |

| January | 1480 | 1520 |

| February | 1495 | 1530 |

| March | 1510 | 1550 |

| April | 1535 | 1555 |

| May | 1550 | 1565 |

| June | 1560 | 1580 |

| July | 1580 | 1600 |

| August | 1605 | 1625 |

| September | 1615 | 1635 |

| October | 1625 | 1650 |

| November | 1640 | 1660 |

| December | 1655 | 1675 |

Read Also: Suzlon Share Price Target 2025, 2026, 2030, 2040 to 2050

DEN Network Ltd Peer Comparison

| Scrip Name | Price | Daily Change | M.Cap (Cr) | 1 Year Returns % | P/E (TTM) | PB Ratio |

|---|---|---|---|---|---|---|

|

Den Networks Ltd

|

34.17 | -0.57 | 1,630.67 | -41.69 | 12.09 | 0.44 |

|

Creative Eye Ltd

|

6.23 | +0.08 | 12.50 | 35.43 | 0.00 | 0.62 |

|

Mukta Arts Ltd

|

74.70 | -0.85 | 168.71 | -14.38 | 18.91 | 0.93 |

|

Wonderla Holidays Ltd

|

634.45 | -3.25 | 4,022.97 | -32.64 | 33.31 | 2.37 |

|

Pritish Nandy Communications Ltd

|

31.61 | -0.29 | 45.73 | -53.34 | 114.18 | 0.61 |

|

Balaji Telefilms Ltd

|

57.72 | -1.10 | 690.27 | -56.70 | 24.49 | 0.52 |

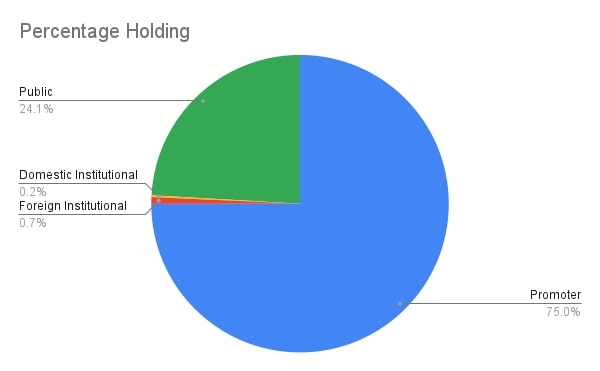

DEN Network’s Holding Pattern

| Shareholder Category | Percentage Holding |

|---|---|

| Promoter | 74.90% |

| Foreign Institutional Investors (FII) | 0.73% |

| Domestic Institutional Investors (DII) | 0.20% |

| Public | 24.07% |

DEN Network Cash Flow

| Particulars | Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 |

|---|---|---|---|---|---|

| Cash and Cash Equivalents at the beginning of the year | 2.07 | 21.32 | 46.77 | 1.33 | 21.11 |

| Net Cash from Operating Activities | 71.10 | 121.19 | 96.72 | 226.72 | 155.14 |

| Net Cash Used In Investing Activities | -51.88 | -27.46 | -218.19 | -317.39 | 499.49 |

| Net Cash Used In Financing Activities | -4.12 | -112.97 | 96.02 | 136.11 | -674.41 |

| Net Inc./Dec In Cash And Cash Equivalents | 15.10 | -19.25 | -25.45 | 45.44 | -19.78 |

| Cash And Cash Equivalents At the End Of The Year | 17.17 | 2.07 | 21.32 | 46.77 | 1.33 |

DEN Network Investment Opportunities and Risk

Look at Opportunities and Risks to invest in DEN Network Ltd. All investors should know about these factors before investing in DEN Network:

DEN Network Investment’s Opportunity:

Before investing in DEN Network Ltd, the investors should focus on the opportunity and Growth factor of the company., which could boost the company’s share Prices in the future. The opportunities factors are given below:

- Increasing internet penetration and digitalization in India boost demand for DEN Network’s broadband services.

- The rising consumption of OTTP platforms and digital content creates opportunities for bundled services.

- Ruler Market Potential and demand among the rural areas for cable TV and broadband services can affect the DEN Network Ltd Share Price.

Risk: The company’s Share Price is in the downward position and it is stuck between ts 35 to 50. Continuously, decreasing revenue and Profit Growth also harm the financial position of the company. Competition from JioFiber, Airtel, and other providers may pressure margins. Evolving telecom and broadcasting regulations could impact operations. So, these are the risk factors, that can make the DEN Network Share tough to compete.

Conclusion

The DEN Network Ltd offers a promising opportunity in the Indian Growing broadband and digital content market, but there is also heavy competition and regulatory challenges. The company’s vision is to provide easily accessible entertaining services to its users. However, the decreasing financial stability can directly harm the Share Price of DEN Network. It can be the best opportunity for investors, who want to look for a small penny stock company. But, investors, should also analyse and evaluate the microeconomic factors of a company like future outlook and company trends.

FAQs

Q: What is the Den Networks Ltd share price today?

A: Today’s Den Networks Ltd shares price on NSE is Rs.34.17.

Q: What is the market cap of Den Networks Ltd shares on NSE?

A: The Den Network has a market capitalization of Rs.1630.67Cr

Q: What is the PE & PB ratio of Den Networks Ltd shares?

A: The current PE is 12.09 and PB is 0.44 for DEN Network Ltd.

Disclaimer: Stock market investments are subject to risks. The predictions provided are based on research and past trends, and investors should do their analysis before making financial decisions. Make sure to ask and consult with industry experts and investors.